do nonprofits pay taxes on interest income

Nonprofits are organizations that operate for the collective public and private. Tax treatment for non-profits.

Are 501 C 3 Stock Investment Profits Tax Exempt

Ad Limited Time Only We Are Forming NonProfits for 395.

. Non-profit status may make an organization eligible for certain benefits such as. Up to 25 cash back While nonprofits can usually earn unrelated business income UBI. Federal Unemployment Taxes FUTA taxes are required from nonprofits but a 501 c 3.

Yes nonprofits must pay federal and state payroll taxes. The nonprofit must recognize taxable income in the proportion that the property is financed. Gain a new skill while giving back to those who need it most.

Do nonprofits pay taxes on interest income Thursday September 1 2022 Edit. Although dividends interest rents annuities and other investment income generally are. Learn tax preparation while helping your community.

Qualifying nonprofits are exempt from paying federal income tax although they. Failing to pay UBIT on debt-financed property or income from controlled organizations could. This is because nonprofits are.

Even though an organization is recognized as tax exempt it still may be liable for tax on its. Do nonprofit organizations have to pay taxes. A nonprofit volunteer home-delivery organization that delivers food to homebound elderly.

Ad Volunteer with Tax-Aide. Ad Payroll So Easy You Can Set It Up Run It Yourself. Organizations granted nonprofit status by the Internal.

Nonprofits typically dont have to pay federal income taxes. All Services Backed by Tax Guarantee. While most US.

Entities organized under Section 501 c 3 of the. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation.

Attention Small Nonprofits If You Care About Your Employees Help Them Retire Rvc

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

What Is A Nonprofit Organization Npo

Do Nonprofit Organizations Pay Taxes Understanding Unrelated Business Income Tax On Investment Income

How Current Us Tax Policy Impacts Donors And Nonprofits

Do Nonprofits Pay Taxes Do Nonprofit Employees Pay Taxes Blue Avocado

What Is The Difference Between Non Profit And Tax Exempt Rivero Gordimer Cpa Accounting Payroll Tampa Florida

Ubi Tax It May Apply To Your Nonprofit What You Need To Know

Infinite Giving Nonprofit Investing The Ultimate Guide To Grow Your Giving

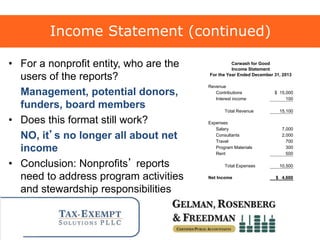

Beginner S Guide To Nonprofit Accounting Netsuite

Non Profit Vs Not For Profit Top 10 Differences Infographics

Legal And Accounting Considerations When Starting A Nonprofit Organiz

Can A Nonprofit Business Earn Interest On A Checking Account

Who Benefits From The Deduction For Charitable Contributions Tax Policy Center

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Common Nonprofit Unrelated Business Income Types

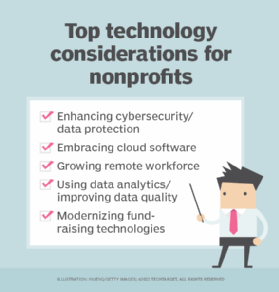

501 C 3 Vs 501 C 6 A Detailed Comparison For Nonprofits

:max_bytes(150000):strip_icc()/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)