8915-e tax form release date

If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year. It looks like the IRS has released.

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)

Form 5329 Additional Taxes On Qualified Plans Definition

Form 8915-F is now available in ProSeries 2021 and should be e-file ready on 03242022.

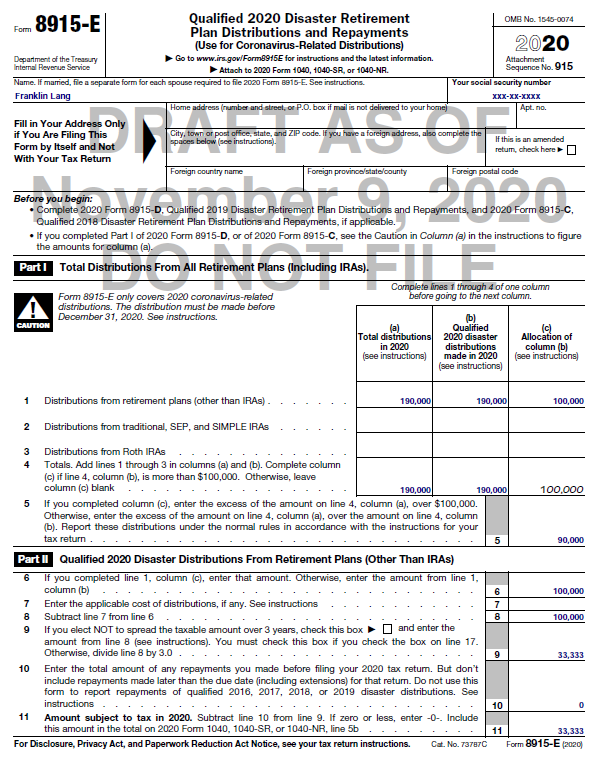

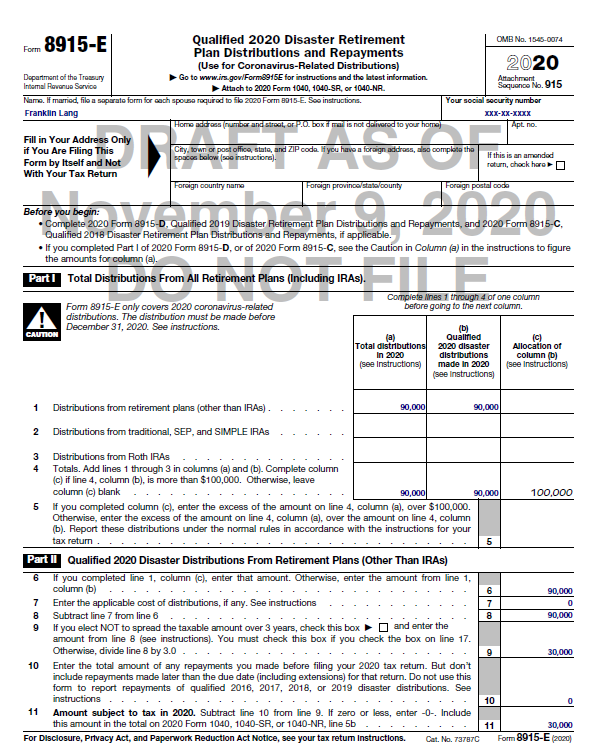

. The remaining 55 of the distribution is taxable on your 2021 and 2022 tax returns 21 23 on your 2021 tax return and 33 13 on your 2022 tax return. Form 8915-E for retirement plans. This form replaces Form 8915-E for tax years beginning after 2020.

Officially the release date is March 31st. Does anyone have an update on when Form 8915-F will be ready The forms release date page has been updated and it shows March 24. Please note that the IRS anticipates to release this Form 8915-E before the end of 2020.

But the expected date of release could be march 2 2022. 03-08-2022 0146 PM. Recently many people have found their lives upside down out of work working less furloughed or.

The 8915-F is scheduled for release on 33122. I predict we will see 8915-F on. April 08 2021.

Examine Form 8915-E to see the. If you were impacted by the coronavirus and you made withdrawals from your retirement plan in 2020 before December 31 you may have coronavirus-related distributions. I just read that it will not be available until march.

Made or received in 2020. The 8915-E is available in the TY20 program only. Please be aware that these.

Turbo Tax Form 8915 E Update. For more information and for assistance in filing your taxes please consult your tax. If you do not yet see the form go to the Update menu and choose Update Installed.

Do not use a Form 8915-F to report qualified 2020 disaster distributions made in.

Fillable Online Form 8898 Rev October 2020 Statement For Individuals Who Begin Or End Bona Fide Residence In A U S Possession Fax Email Print Pdffiller

Tax Information Center Forms H R Block

Taxes On Cares Act Ira Withdrawals Form 8915 E Youtube

Irs Provides Details On April 15 Postponement Journal Of Accountancy

Publication 4492 A 7 2008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

National Association Of Tax Professionals Blog

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915 E Explained Youtube

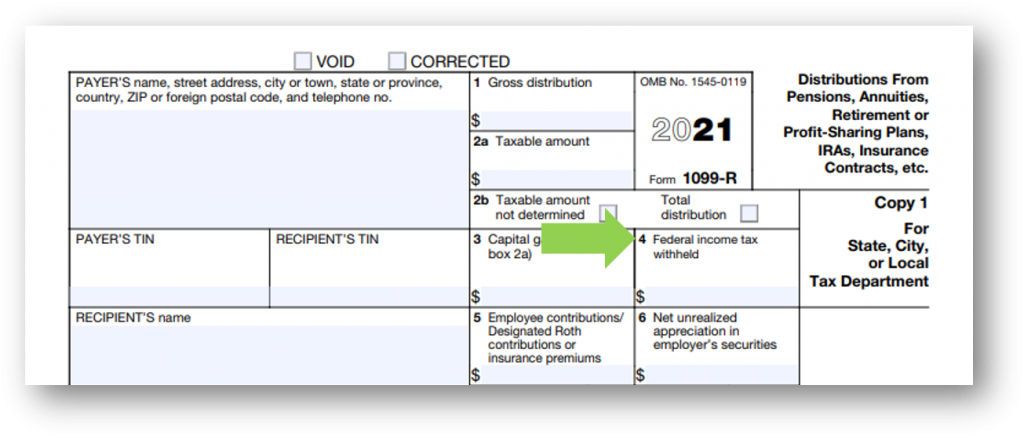

Tax Form Focus Irs Form 1099 R Strata Trust Company

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

Form 8915 E For Retirement Plans H R Block

File Online 3 Steps To 100 Free Tax Preparation

Tax Form Focus Irs Form 1099 R Strata Trust Company

Delbene Tax Prep Dispatch The Eitc Lookback Is Back It Never Left Prosperity Now

Tax Information Center Irs H R Block

When Will Form 8915 E 2020 Be Available In Turbo Tax Page 19

National Association Of Tax Professionals Blog

Form 8915 E Partial Repayment Results In 0 Crd Tax Liability For 2020 R Tax

Irs Issues Form 8915 F For Reporting Qualified Disaster Distributions And Repayments Provides 2021 Forms For Earlier Disasters